does yonkers pay nyc tax|What are the tax pros and cons of living in Yonkers but working in : Clark Residents of Yonkers are subject to the Yonkers Resident Withholding Tax. This tax must be included in paychecks for all employees who live in Yonkers. This tax applies to . CSC Quick Survey. Dear Visitor, Thank you for visiting the official website of the Civil Service Commission. Before you can proceed with the download, may we ask you to help us out on a survey for us to better improve our services. 1.) Sex. Male. Female. 2.) Age. 18 to 24. 25 to 39. 40 to 60.HAIL, MYTHICAL HEROES! After a month of previewing the latest changes to the game, we are incredibly excited to officially introduce the next major update for Age of Mythology: Extended Edition: UPDATE 2.8!. With the .

does yonkers pay nyc tax,Yonkers taxes you if you live or work in Yonkers, but NYC only taxes you if you live there (you are not taxed in NYC for your work performed there). If you live in Yonkers and work in NYC, you will be taxed by Yonkers on your NY State return for .Pay Online. Pay Online via Credit Card or Electronic Check. Enter the account number (11 digits) exactly as it appears on the City Tax bill. Late Payment. If your payment is late, .

Residents of Yonkers are subject to the Yonkers Resident Withholding Tax. This tax must be included in paychecks for all employees who live in Yonkers. This tax applies to .Yonkers has local income tax for residents, so residents of Yonkers pay only the New York income tax and Federal income tax on most forms of income. The Yonkers .Payment Options. Mail: Please direct all tax payments to the following: City of Yonkers 40 South Broadway Room 108 Yonkers, NY 10701; In Person: Pay in person at City Hall, . NY state tax rates are 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.5%, 10.3% and 10.9%. Here's who pays New York state tax, residency rules and what's taxable.New York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Non-Resident .Residents. Taxes & Water. Your tax dollars fund essential city services such as garbage pick-up, the parks system, programs for seniors, and the Board of Education. Learn .does yonkers pay nyc tax What are the tax pros and cons of living in Yonkers but working in Yonkers Mayor Mike Spano today announced the launch of the City’s new free online property tax information portal allowing residents to view their property tax .

When you prepare the New York resident return (for New York State), NYC resident and Yonkers resident or nonresident wage tax is reconciled as part of the state return. Therefore, if you were not an .Pay online. Visit www.nycbootpay.com to pay by credit or debit card. Pay by phone. Call Republic Immobilization Services at (646) 517-1000 to pay by credit or debit card or bank account withdrawal. Pay in-person. Before visiting a business center regarding a booted or towed vehicle, please be aware of the following:Lol. NYC taxes residents or anyone who works for the city. Yonkers taxes both residents or people who work in Yonkers even if they don’t live there. Have been wondering this for years. 65 votes, 27 comments. Every year, I get about 2-5 prompts on my taxes that ask about Yonkers.

Does Yonkers pay NYC tax? Yes, residents of Yonkers are subject to the Yonkers Resident Withholding Tax. This tax must be included in paychecks for all employees who live in Yonkers. Additionally, both New York City and Yonkers have their own local income taxes in addition to the state tax.

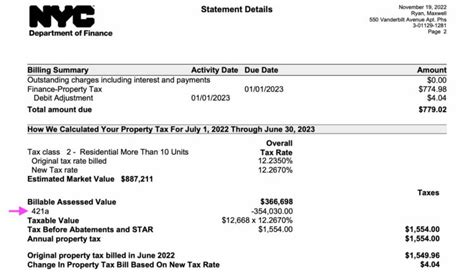

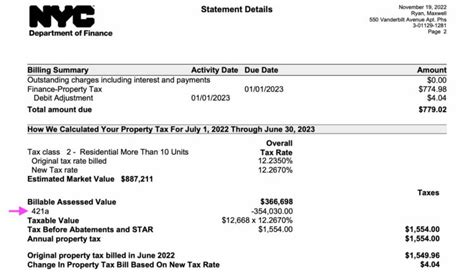

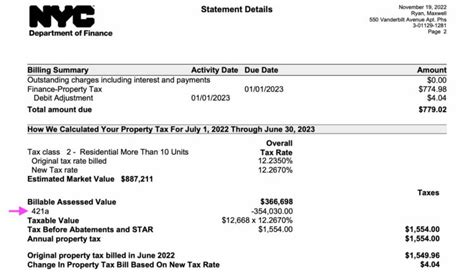

Does Yonkers pay NYC tax? Residents of Yonkers are subject to their own local income tax in addition to the state tax. However, Yonkers residents do not pay New York City income tax. Is the Bronx NYC or Yonkers? The Bronx is considered one of the five boroughs of New York City and is separate from Yonkers. It is located to the north . Property owners owing property taxes beyond the last two years can look up their past due balances but must pay in person at Yonkers City Hall or mail a check to the City of Yonkers Tax Department. For more information on the online property tax portal contact the City of Yonkers Tax Department at [email protected] or 914 .

NYS-50-T-Y (1/22) Yonkers Withholding Tax Tables and Methods Effective January 1, 2022 The information presented is current as of the publication’s print date. Visit . as if the total were a single payment. Subtract the tax already withheld from the regular wages. Withhold the remaining tax Yes. You would file a New York resident return with part-year NYC residency and enter the number of months you lived in NYC. Your total wages and all your additional income (such as capital gains) should be allocated for those months as a NYC resident. You will only be liable for NYC tax during the time frame you were a NYC resident. .

New York State Tax Quick Facts. State income tax: 4% - 10.9%. NYC income tax: 3.078% - 3.876% (in addition to state tax) Sales tax: 4% (local tax 3% - 4.875%) Property tax: 1.73% average effective rate. Gas tax: 25.35 cents per gallon of regular gasoline, 23.7 to 25.3 cents per gallon of diesel. For taxpayers in the state of New York, .New York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Non-Resident Employees of the City of New York - Form 1127. Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127.

Line 6 Total nonresident earnings tax – Enter the total Yonkers nonresident earnings tax. Figure the tax by multiplying the amount on line 5 by the rate of 0.5% (.005). Also transfer your total Yonkers nonresident earnings tax to your New York State return. Submit Form Y-203 with your New York State return. New York unemployment insurance. In 2024, on the first $12,500 each employee earns, New York employers also pay unemployment insurance of between 2.1% to 9.9%. In 2023, it was $12,300. Certain churches and non-profits are exempt from this payment. If you’re a new employer, you’ll pay a flat rate of 4.1%. The NYC income tax rate ranges from 3.078% to 3.876% based on your income. This tax applies to everyone living in the city and is paid annually along with your New York State taxes. The combined state and city income tax rates can go from 7.078% to 14.776%, making it one of the highest tax burdens in the country for top earners.Bills are mailed: Quarterly (four times a year) Payment is due on July 1, October 1, January 1 and April 1. more than $250,000. Bills are mailed: Semi-annually (2 times a year) Payment is due on: July 1 and January 1. Property tax bills & payment information Tax rates Requirement to pay by electronic funds transfer (EFT) requirement.

What are the tax pros and cons of living in Yonkers but working in By Andrew Weinberger. May 20th 2024. Share: Those who live in NJ but work in NYC are exempt from NYC income tax. However, you must file a New York non-resident return (IT-203) and a New Jersey resident income return (NJ-1040). Read along to find out more about which taxes to file to where to file them.County Tax. Pay by Phone. Tickets. Water Bill. Online Payments. Recycling Guide. FOIL Requests. Newsletter Signup. Employment Opportunities. Contact Us. Yonkers City Hall 40 South Broadway Yonkers, NY 10701 Phone: 914-377-6000. Quick Links. Assessment Roll. City Council. CodeRED. Departments. . Welcome to the City of Yonkers On-Line .

does yonkers pay nyc taxNY will give a credit for taxes paid to other states, but they won't do that for the Yonkers nonresident earnings tax. Thankfully, the Yonkers non-resident surcharge is a fairly low rate of 0.5% So someone living in NYC, but making $140k in Yonkers, will pay $700 in nonresident earnings tax and may owe around $4,000 in NYC resident taxes.You must pay the Real Property Transfer Tax (RPTT) on sales, grants, assignments, transfers or surrenders of real property in New York City. You must also pay RPTT for the sale or transfer of at least 50% of ownership in a corporation, partnership, trust, or other entity that owns/leases property and transfers of cooperative housing stock shares.

does yonkers pay nyc tax|What are the tax pros and cons of living in Yonkers but working in

PH0 · Yonkers Resident Withholding Tax

PH1 · What are the tax pros and cons of living in Yonkers but working in

PH2 · What are the tax pros and cons of living in Yonkers but

PH3 · Taxes & Water

PH4 · Real Property Tax

PH5 · Personal Income Tax & Non

PH6 · New York State Income Tax Rates and Brackets

PH7 · New York City, Yonkers, and MCTMT

PH8 · Does Yonkers belong to NYC?

PH9 · City of Yonkers Launches New Online Property Tax Info Portal

PH10 · City of Yonkers Income Tax Rate

PH11 · City Tax